Fraud and identity theft are no longer rare occurrences; they’re a daily challenge for businesses operating online. Every new signup, transaction, or partnership carries the risk of impersonation or false information.

That’s why implementing the best identity verification service is a strategic move to protect your business, customers, and reputation.

In this article, we’ll explore the key features to look for in an identity verification solution, helping you choose a platform that keeps your operations secure while providing a smooth experience for legitimate users.

What Is Identity Verification Software?

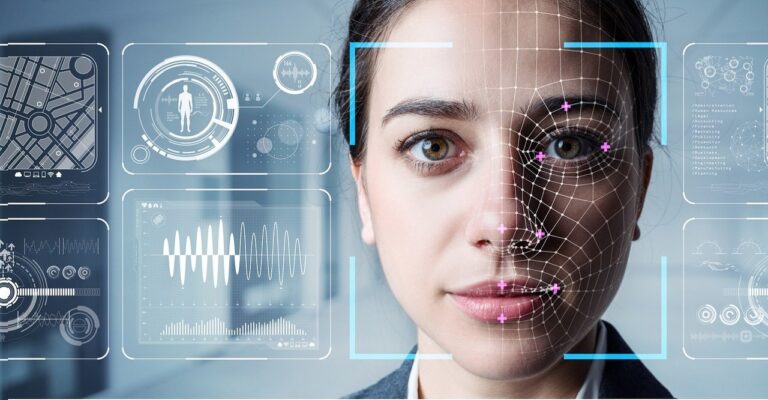

Identity verification software is a technology-driven solution that confirms the authenticity of individuals or businesses. These services ensure that the person or organization you’re dealing with is legitimate, reducing risks associated with fraud and regulatory violations.

Modern identity verification tools use a combination of:

- Document authentication – checking passports, government IDs, driver’s licenses, or corporate documents.

- Biometric verification – using facial recognition, fingerprints, or liveness detection to ensure a real person is submitting the information.

- Database cross-referencing – validating information against trusted government and financial databases.

- Behavioral analytics – detecting suspicious activity or anomalies during the verification process.

Industries like fintech, lending, crypto, eCommerce, and healthcare rely heavily on these solutions to ensure compliance with KYC (Know Your Customer), KYB (Know Your Business), and AML (Anti-Money Laundering) regulations.

8 Features to Consider When Choosing an Identity Verification Service

Here are the main features to look for when picking an identity verification service for your business. These will help keep your operations secure and make the process easy for your customers:

1. Comprehensive Verification Methods

The best identity verification service combines multiple verification methods for accuracy and reliability. Using only one method, like document verification, can leave gaps that fraudsters exploit. Look for solutions that offer:

- Document Verification: Checks the authenticity of government-issued IDs and corporate documents. For example, some services can detect altered or expired documents.

- Biometric Verification: Matches a person’s face or fingerprint against official records. This ensures that the person submitting the information is actually present.

- Database Cross-Referencing: Confirms details such as name, address, and date of birth against authoritative sources like credit bureaus or government databases.

- Liveness Detection: Ensures the user is physically present during verification, preventing spoofing through photos or videos.

Having multiple layers of verification increases accuracy and reduces the risk of fraud, which is especially important for high-value or high-risk transactions.

2. Regulatory Compliance

Compliance is non-negotiable. Regulations vary by country, but the core aim is to prevent money laundering, terrorism financing, and identity fraud. The best services adhere to global and local standards such as:

- KYC (Know Your Customer) – confirming the identity of individual customers.

- KYB (Know Your Business) – verifying businesses and their ownership structures.

- AML (Anti-Money Laundering) – monitoring transactions for suspicious activity.

- GDPR (General Data Protection Regulation) – protecting customer data for users in Europe.

- FATF (Financial Action Task Force) – international standards for financial compliance.

Choosing a service that meets these standards not only reduces legal risk but also builds trust with your customers.

3. Scalability and Performance

As your business grows, your verification needs may increase dramatically. A solution that works well for 100 users per day may fail when processing thousands. Consider:

- High throughput – the ability to process a large number of verifications simultaneously.

- Low latency – fast verification times that don’t frustrate users.

- Flexible pricing models – options like pay-per-use or subscription plans to match your growth.

Scalable systems ensure that your business can expand without disruptions in customer onboarding or compliance processes.

4. User Experience

A seamless verification process improves completion rates and customer satisfaction. Complicated or slow systems often lead to abandoned applications. Look for services that provide:

- Mobile-friendly interfaces – users can verify identities from smartphones and tablets.

- Multi-language support – critical for businesses with international customers.

- Guided workflows – intuitive steps that clearly show users how to complete verification.

Remember, identity verification should protect your business without frustrating legitimate users.

5. Integration Capabilities

Your verification service should integrate smoothly with your existing business systems, such as:

- Customer Relationship Management (CRM) tools

- Payment gateways

- Enterprise Resource Planning (ERP) systems

- Human Resource (HR) platforms

Look for solutions that provide:

- APIs and SDKs – allowing developers to connect systems quickly.

- Pre-built connectors – ready-made integrations for popular platforms to save time and costs.

Seamless integration ensures that verification becomes part of your workflow rather than a separate process.

6. Advanced Fraud Prevention

Fraudsters are constantly finding new ways to bypass security measures. Choose a service that actively protects your business by offering:

- Real-time fraud detection – identifying suspicious activities as they occur.

- Risk scoring – evaluating the likelihood of fraud based on data and behavior patterns.

- Watchlist screening – checking users against global sanction lists and PEP (politically exposed persons) databases.

A strong fraud prevention layer minimizes financial losses and protects your brand reputation.

7. Data Security and Privacy

Handling sensitive personal data requires robust security. Look for verification services that:

- Encrypt data – both at rest and in transit using advanced encryption standards.

- Comply with local laws – ensuring data residency and privacy regulations are met.

- Conduct regular audits – undergoing third-party security assessments to identify vulnerabilities.

Data breaches can be far more costly than the verification solution itself, making security a top priority.

8. Customer Support and Service

Even the best technology requires reliable support. A good provider should offer:

- 24/7 support – available to handle emergencies anytime.

- Multiple communication channels – phone, email, or live chat.

- Dedicated account managers – personalized assistance for enterprise clients.

Responsive support ensures issues are resolved quickly, minimizing disruptions to your business operations.

How to Make the Final Decision

When evaluating identity verification services, consider these practical steps:

- Assess Your Risk Profile: High-risk industries like fintech or crypto require more comprehensive verification.

- Compare Features: Ensure the service meets your business needs in compliance, user experience, and fraud prevention.

- Request a Demo: Test the platform with real use cases to see how it performs.

- Check References: Talk to existing customers to understand reliability and support quality.

- Evaluate Cost vs. Value: Don’t just choose the cheapest solution; consider the long-term value of accuracy, compliance, and customer trust.

Final Thoughts

Selecting the best identity verification service is more than a compliance checkbox; it’s a strategic decision that protects your business, strengthens customer relationships, and supports growth.

By focusing on features like comprehensive verification methods, regulatory compliance, scalability, user experience, integration capabilities, fraud prevention, data security, and reliable support, you can choose a solution that meets your current needs and scales with your business.

Investing in a robust identity verification solution not only prevents fraud and legal issues but also creates a seamless onboarding experience that builds trust and loyalty. For businesses looking to expand globally or operate in high-risk sectors, the right service can make all the difference.